Quick loans are appealing to many. It’s the only way to meet unexpected financial circumstances arriving in the middle of the month when nothing else works. As the title suggests, ” No Credit Check” means you do not have to be worried about bad credit scores to borrow cash for emergency payments.

The idea of quick loans with no credit check is simple: helping the needy in tough times and keeping your pace even in the worst financial situations.

Our direct lenders focus on the convenience of customers than anything else. We prioritize you above all else and can grant you a loan even with a minimal fee.

To access loans faster and approve your application quicker, read the article. Just apply for a payday loan, and we will take care of your short term financial needs.

Some Important Points of Quick Loans

As the name suggests, quick loans are available in the fastest way to fulfil all your financial needs and expenses arriving unexpectedly. These loans are fast to process than any other traditional loan.

Whether you have bills to pay or a car to repair, we are here to help you. You can borrow quick loans for a shorter period to fulfil short term expenses.

These loans are usually for 2 to 4 weeks, and the whole amount with an additional fee should be paid at the date of maturity. In case of non-repayment, your loan can be extended for further weeks.

Quick loans are also known as

- Payday loans

- Emergency loans

- Cash advance

- Instant loans

- Same day loan

- Fast cash loans, etc.

Loans With Poor Credit Score

Credit scores are assigned by major credit bureaus revealing your financial health and credit history over a period. It provides an estimation of your creditworthiness and how good are you at paying your debt off.

| Credit Score Range | Comment |

|---|---|

| 300 – 580 | Poor |

| 581- 670 | Fair |

| 671 – 740 | Good |

| 741 – 800 | Very Good |

| 801 – 850 | Exceptional |

If you have a good credit score of more than 670, you will not face any issues while borrowing a loan. Whether it’s a bank or any other financial institution, anyone can grant you a loan. The problem arises when you have a bad credit record.

A bad credit score means you are not worthy of being granted a loan. Many lenders and financial institutions are concerned about bad credit history and are reluctant to lend you a loan.

Finding a loan with bad credit is a herculean task leading toward nothing but discouragement. At our place, you will not be facing such problems. Our lenders have helped many like you. Our direct lender prefers only soft credit inquiries.

Apply even if you have bad credit scores. Our lenders use other criteria to check your capacity for repayment of the loan.

Soft Vs Hard Credit Inquiry

In the para above, I used the term “Soft Credit Inquiry.” You must be wondering what this giant is. Let me be simple. Soft credit inquiry doesn’t count a person’s credit score or give much importance to bad credit history.

On the contrary, banks and other institutions conduct hard credit inquiries in which they do consider and investigate your credit report and grant loan accordingly.

Application and Approval of Quick payday loans in 1 business day

The procedure to apply for quick loans online is a piece of cake. Just follow 4Cs to apply for quick loans even with poor credit ratings.

Check

Firstly, you need to check whether you are eligible for loans or not. Maybe you do not qualify for the loan, still apply and are rejected. Perhaps you think you are not eligible owing to terrible credit scores, but in the eyes of a lender, you possess all traits to secure the loan.

To save your time and energy, we have enlisted criteria for your eligibility for a loan given by our payday lenders.

- You must be 18 years of age.

- You should have an active bank account for depositing money directly

- Your steady income shouldn’t be less than $1000/ month

- You shouldn’t be a military officer

If you fulfil all these points, move towards another section.

Collect

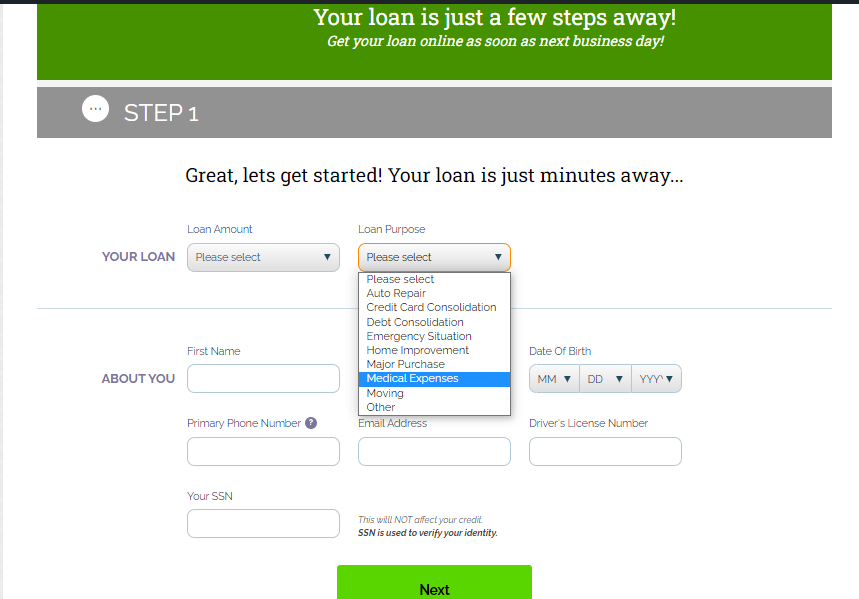

Our lenders also require certain documents and information while you are submitting the application. We suggest keeping all of them with you before applying. Some of the most important documents and credentials are:

- Personal details

- Social Security Number (SSN)

- Home address

- Email address

- Phone number

- Income information

- Bank details

- Account number

- Routing number

Complete

Once you have collected information and documents, now is the time to dig for treasure. For a loan request on our website, click the “Apply button”; complete your credentials, upload documents, and submit the form.

Once your application is submitted, we will take it to our network of multiple lenders, one of whom will then approve it. You will receive an email and pop up on our portal. The lender will send you a loan agreement encompassing details of:

- Loan amount

- Loan fee

- Annual Percentage Rate

- Loan repayment

- Outcomes of non-repayment

Cash

Once you agree to the loan agreement terms, the lender will directly deposit the amount into your bank account. This whole process from submission to money transfer will not take more than 1 business day.

Signs Why Quick Loans With No Credit Check are the Best

Quick loans without considering borrower’s credit history have so far the best loans in the town. From an exhaustive list, some of the benefits of quick loans are discussed below.

Quick Loans Require No Collateral

Yes, quick loans require no collateral. These are unsecured loans that can be taken for a shorter period. Collateral is an item you keep with the lender against the loan. It can be your house, jewellery or car. In case of non-repayment, the lender will repossess it.

Quick loans are quick to process

The whole article emphasizes how quick you can get payday loans. You don’t need to visit any office. Just sit comfortably in bed, even on weekends, apply with a few clicks and approve in minutes.

Quick loans are Faxless

Traditionally, you were required to fax documents while borrowing a loan. Many don’t have fax machines and find the process hectic and tiring.

Digitization has changed the world. Climate activists are urging people to let go of the use of papers. Every business is turning paperless. So is our lending process. There is no need to fax; click a picture of your document and upload it during submission of an application.

Quick loans cover emergencies

Many lenders require you to provide a reason before taking a loan. However, we are not nosy. We are least concerned with where you are spending the loan amount. You can spend your cash to cover any short term emergency as car repair, debt consolidation, or wherever you want.

Simple Repayment

Quick loans are easy to repay. The lender will deduct the amount on the loan’s maturity period. If not, then you can also transfer to his account.

If you can not repay the amount at the right time, do not worry. Your loan may be extended for a further period with an additional fee. This is subject to the laws of the state.

In an extreme case, too many outstanding debts over a period of time may harm your credit ratings. So, be careful while borrowing a loan and repay on time.

We Are Direct Lenders

A borrower usually has two options to process a loan.

- Borrowers can apply in person with each lender.

- Borrowers can apply through third party lenders.

If you are applying in person, you can visit the lender’s office or apply through the lender’s website. However, this is time-consuming.

We recommend you apply with third party lenders or brokers. We connect you with direct online lenders for bad credit loans at one time with one application, and you will get approval soon as possible.

Is There Any Alternative to Payday Without Credit Check Loans?

Personal Loans

Personal loan are long term and short term loans with favourable interest rates. A payday loan is also a part of personal loans. The amount can also be paid in a series of payments for those who cannot manage the lumpsum together.

Personal Installment Loans

Personal loans are as similar as payday loans. You need to follow the same procedures to borrow the loan. However, the payment schedule is a bit different. You can repay the loan in a series of payments due weekly or monthly.

Pawn shop Loans

These loans require collateral and are secured loans. The loan amount reimbursed by the lender is similar to the value of the item you keep.

Improve your Credit Score

You can improve your credit score in several ways.

- Pay your bills on time

- Repay your debts

- Don’t borrow if you can repay the loan

FAQs

Conclusion

Quick loans without credit checks are needed for the day. Those who are facing financial repression can use these loans before their next salary. These loans are easy to process and quicker to get, not more than in 1 business day.

We have covered nearly all aspects of the article. Yet, if you have any other problems, contact us anytime.