Sometimes paycheck is not enough to meet all expenses. This is the reason why many take payday loans. As per rough estimates of Pew Charitable Trust, 12 million Americans borrow payday loans every year.

They borrow payday loans to fulfil their unexpected emergencies. An emergency is something that can arrive anytime without any prior notice. However, many came to question something most important. Does payday loan affect your credit score?

It is pretty tough to answer because you usually expect to pay your debts on time. However, taking a payday loan would not affect your credit scores. This is why we are here. So don’t panic. Start reading the article to get all your answers.

ways a payday loan can hurt your credit score

Your loan can be rolled over, but failing to pay the loan back on time may hurt your credit score. Each of the following scenarios can lead to lower credit scores like

- Your payday lender may send your debt reports to credit bureaus or credit reporting companies.

- Your payday lenders may lawsuit you for not paying debts. If you lose the case, then your credit scores may be damaged.

- The cycle of too many outstanding debts may cause you to default your payments programs, which negatively impact your credit ratings.

Does payday loan affect your credit score?

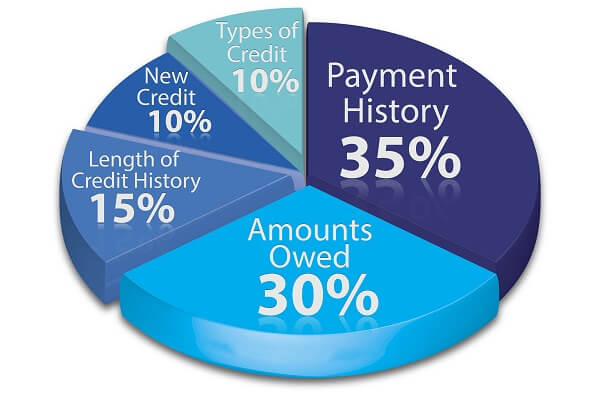

FICO Score is quite famous for revealing your credit history. A credit score is revolved around many factors as

- Payment history

- Amount owned

- Credit history length

- New credit

- Credit history length

Credit reports are documents containing your borrowing history. These include details like your outstanding balance, on time and off time payments, bankruptcy filings, hard credit checks, etc. Credit bureaus maintain these reports.

If your credit score is higher than 630, you can get a loan anytime. If lower than that, lenders and financial institutions are reluctant to grant you the loan.

Payday loans affect your credit score only when you have too many outstanding debts—the lender may send your credit report to three major credit bureaus or nationwide credit reporting companies.

Payday Cash Advance

Cash advances are of two types.

- A cash advance on your credit card

- Cash advance as a payday loan

You can take a cash advance on the credit card. Banks offer such advances to meet emergencies that you need to return with an extra fee plus an ATM fee. The number of fees added to your credit cards.

The second type of cash advance is short term credit check loans. These cash advances are borrowed till your next paycheck, which you need to be repaid in a span of 2 to 4 weeks.

You need to pay the whole lump sum together on the maturity date. These loans are also known as online payday loans, quick loans, fast loans etc.

How to take cash advances?

The procedure for online payday loans is simple and easy to process. This won’t take more than 10 minutes.

After checking if you are eligible, start applying for the loan process. You don’t need to visit the lender office. Our process is online, so click the green button below and start the application. You need to fill in details with accuracy.

The details contain your personal information like home and email address, Social Security Number, employer details and bank information like an account number. Once filling the form, upload all the required documents.

Now, submit the form and wait for the approval. We will then take your form to a pool of lenders online, one of whom will approve your application.

The lender will send you details regarding the loan amount, loan fee, Annual Percentage Rate, maturity dates, etc. Once you confirm the agreement, the lender will directly transfer the money into your bank account.

Who is eligible for payday loan debt

Different lenders have different criteria for a payday loan. Our is a bit different. Though our lenders do not conduct hard credit inquiries, they check your repayment capabilities to determine whether you can repay the loan or not.

For your ease, we have devised criteria helpful in confirming whether you should proceed with the loan application or not.

- You should be 18 above -adult as per US laws.

- You should be financially independent, having an income of $1000

- You should have an active bank account

- You shouldn’t be a part of any military service

What are the repayment terms for payday loan borrowers

Many who have borrowed loans are deemed to repay on time. You usually have two ways to repay the loan. The lender will deduct the amount from your account at the date of the loan’s maturity, or you can also transfer money to the lender’s account.

In case if you cannot repay the debts, they can be extended with an additional fee for a further period of time. This totally depends upon your loan agreement with the lender and the laws of your state.

Will a payday cash advance loan show up on your credit report?

The answer here is no. Payday loan history doesn’t really show on your credit report unless you haven’t paid the amounts yet.

Since payday loans are part of bad credit or no credit check loans, the lender will not conduct any credit inquiry before granting you a loan.

Therefore, they do not report payment information to credit bureaus. These lenders run soft credit checks in which any information neither affect your credit ratings nor your credit borrowing.

3 alternatives to a payday or personal loan

Like payday, there are many other short term personal loans that you may consider before taking any credit. Some of them are

Installment loans

Installment loans do not require any hard credit checks. These loans are taken for a specific period of time but can be repaid in a series of monthly or weekly payments over time—these loans of shorter-term and a part of personal loans.

Credit Union Loans

Credit unions are non-profit organizations helping their members take loans to meet their financial needs. These loans are to be taken for a specific period of time without any credit check and at lower interest rates. You need to join a credit union for taking such benefits.

Pawnshop loans

Pawn shop loans are secured short term loans requiring collateral against the loan amount. In such loans, your approved amount correlates to the value of an item you keep with the lender. That item could be your jewellery, house or car.

Should you get a payday loan?

It really depends. We would recommend taking a payday loan when you need money urgent. Payday helps meet all unforeseen expenses before your paycheck.

However, do consider and estimate the total loan expanse, also check whether you can repay the loan on time or not. You can use payday for

- Automobile repair

- House repair

- Sudden fees

- Death

- Birth

- Anniversary

- Vacations

- Medical bills

Faqs

Conclusion

If you haven’t taken a payday loan yet owing to many reasons, your wait has been over. Our payday loans are issued from trusted lenders against conducting any hard credit inquiry, and you can take a loan even with a bad credit score.

Similarly, if you cannot pay the loan, this too won’t be reported to anyone. However, as always, we highly recommend repaying your debts on time because too many debts may hit your credit ratings. Don’t wait and start your loan request today.