If you have already decided to borrow a payday loan but are confused about whom you should choose, this article is for you.

Payday is a short term borrowing taken to meet financial emergencies. Emergencies wait for none. Whether you are delighted to be a new parent or sad about the death of your loved one, every event requires money, and if you are out of it, payday can rescue you.

Now the point is, whom you should go to? Usually, you have two choices. You may choose a lender and visit in person, or you can avail the services of brokers who can connect you with multiple lenders.

Choosing a lender or broker is not an easy nut to crack. A single mistake and all your efforts plus time go in vain. We have also received many complaints about the fraud of lenders who are looting borrowers’ money through hidden feeses. So, You need to be extra cautious before finalizing any of them.

I would always recommend brokers. Why? Dive deep in the text below to discover the answer to all your queries, and compare direct payday lenders vs payday brokers before finalizing any of them.

Science of Payday Loans

Wondering what actually payday loans are? Simply speaking, payday is an unsecured loan usually taken to finance moments before your next paycheck. These are short term loans payable until your next payday or in 2 to 4 weeks.

Also, if you were unable to repay the loan, don’t be anxious. Your loan amount may be extended or rolled over with an additional fee for a further period. These loans are also known as two-week loans, quick loans, fast loans, online payday loans, etc.

Direct lenders vs brokers: Explanations & Benefits

As mentioned above, any payday borrower usually has two options to apply for payday loans.

- They can apply for direct payday loans in person or online

- They can apply through brokers

First, let’s understand the definitions and meanings of these two-term before enlisting their differences.

Direct lenders

A direct lender is a financial organization regulated by the state to grant personal loans like payday or installment loans. Direct lenders are single companies with whom you apply personally.

You can visit them physically by locating their offices nearby you or applying digitally through their websites or applications. If you qualify for the loan, you get the amount deposited into the bank account and repay in a short period.

Brokers (Third Party Lenders)

Now, who brokers are? For payday, the definition of a broker is a bit different. The word comes out from “brocour”, which means negotiator. A broker is a negotiator acting for two opposite parties for achieving a similar goal.

A broker for a payday loan is a third party lender who can connect you with a pool of multiple lenders with one application helping you to get approval with the least chances of rejection.

Direct payday lenders vs payday brokers

Both direct lenders and brokers have benefits in their horizons, and after extensive research, we have compiled some of the most important perks and privileges you can get by both of them. Please refer to the chart below to better understand the debate between the two.

| Direct Lenders | Brokers |

|---|---|

| If you want to deal with one lender, choose a direct lender. | If you want to deal with multiple direct lenders, choose brokers. |

| One application for one lender. | One application for numerous lenders. |

| With a direct payday lender, you do get a quick decision. If there is any delay, then what’s the use of payday? So every lender tries to be on time for borrowers while lending payday loans. | It says,” apply with brokers and save your time.” You don’t need to waste time while applying with single lenders. We can connect you with many of them at a time. |

| From direct lenders, you do have chances of rejections. | Brokers give you a fair chance of 99.99% guaranteed approval. |

| Lenders may do investigate your credit scores and may conduct hard credit inquiries. | The broker’s job is to send your application to multiple lenders. So, they don’t investigate your personal information. |

| Chances of fraud are high with direct lenders. | Brokers usually have trusted lenders, so fraud is limited to none. |

| You may not get many other options with direct lenders. | You may get much more options with brokers. Like installment loans. |

We are also top rated brokers for online payday loans

You are incredibly secure with us. We are also brokers dealing online for payday loans. With our online system, you would get multiple benefits. Some of them are:

Easy Application

You do not need to move from here and there for a loan. Just sit comfortably On your armchair and apply even on weekends. Similarly, our application process is simple, easy and fast. Spare 10 minutes of your day and get cash in hours.

Quick Approval

We have the quickest approval process. We take your application to the network of multiple lenders online. One of them will then approve it. This whole process won’t take more than 1 business day.

Guaranteed Approval

No one can claim a 100% guarantee over anything, yet we try our best to get your loan approved even if you have bad credit scores.

Faxless Loans

Unlike traditional payday loans, our offered online payday loans are completely faxless. It doesn’t mean we are obsoleting documents. We do require documents, but the process is easy now. You need to click pictures from your electronic device and upload them on the portal. Simple!

Minimum Fee

We also try to convince our lenders to minimize the fee amount as much as possible. While applying with lenders in person, you don’t have such options. You can’t negotiate on the fee.

Limitless spending

Unlike other lenders, we don’t restrict any of our borrowers. You can spend loans anywhere. You can repair your house or car, pay your bills and fees or finance any other emergency with our loans.

Encrypted System

We understand why many borrowers are reluctant to apply online for a loan. However, we ensure top-notch security for our clients. Our website is SSL protects. You can also check the “HTTPS” in the URL, proving the site’s security from any cyber attack.

3 Things You should consider before applying with a Third party lender

If you have decided to move with the broker but are confused about what to do, we are again here to help you. We have devised a simple process to apply for payday loans. However, before moving to it, let’s first keep all your weapons ready.

Estimated Loan Amount

Always be cautious before applying for a loan. The consumer financial protection bureau recommends calculating the estimated loan amount before borrowing. Take fee, interest rate and other factors into consideration to evaluate whether you can repay the amount or not.

Check your eligibility

Do check your eligibility. Our direct lenders do not conduct hard credit inquiries; however, they evaluate your repayment capacities through other determinants you need to fulfil to get a loan. Some of the crucial points are:

- U.S. resident

- 18 above

- Financially independent

- Income of $1000

- Active bank account

- Non military personnel

Arrange all Documents

Before kicking off an application process, keep all documents and essential information ready with you. Some of them are:

- Personal data

- Social Security Number

- Email and home address

- Phone number

- Income proof

- Bank information

- Bank statement

- Account number

- Routing number

Start your application With US

Loan Request

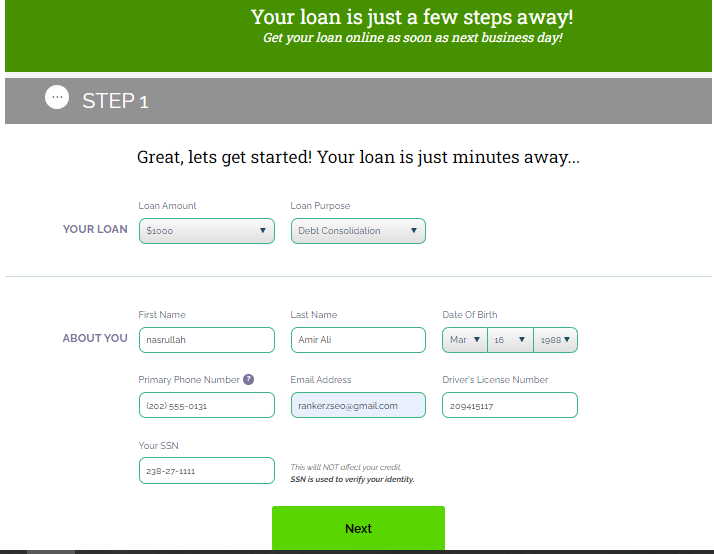

Step 1:

Start filling all the required fields to start a loan application for a direct payday loan. In step 1, you need to add your details, the purpose for taking a loan and your preferred loan amount.

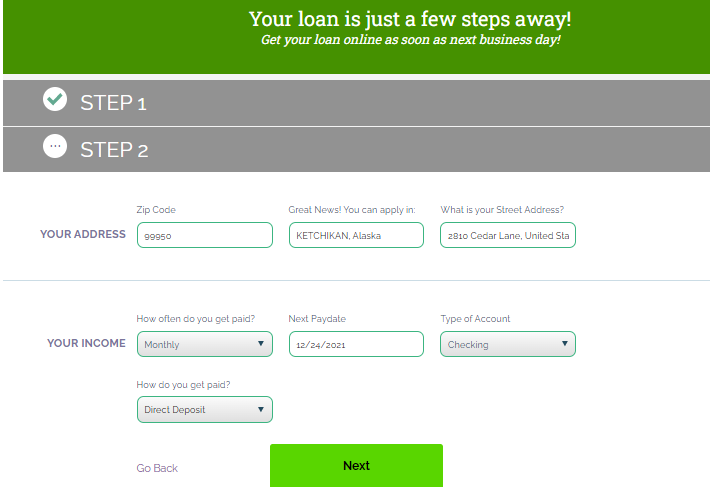

Step 2:

After filling all the fields, click the “Next button” and move on to the second step. The second step generally contains information regarding your financial position. You need to add your bank and income details for payday lending.

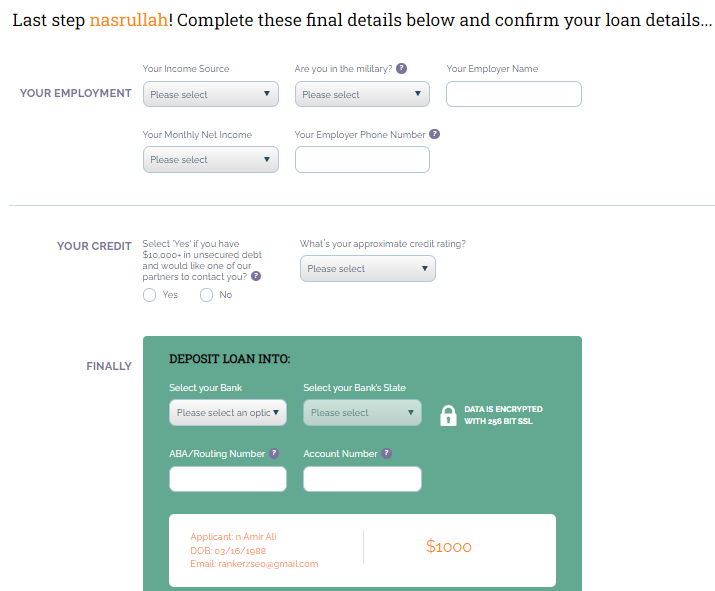

Step 3:

At the third and final step, you must add all relevant details regarding your employment. You will also be asked to submit information about your financial institution or bank for direct deposit of the loan amount.

Loan Agreement

Once you submit the form, we will take it to multiple lenders. One of whom will approve and send you details regarding loan agreement containing:

- Approved loan amount

- Loan fee

- Interest rates

- Annual Percentage rate

- Loan maturity

Get the funds

After approval from both sides, the lender will directly deposit the money into your bank account. However, you can withdrawal money only when you get clearance from your financial institution.

Repayment To Brokers

As for borrowing, you have many options available to repay the loan. In most cases, the lender will directly deduct the amount from your account on the date of the loan’s maturity. However, you can also transfer money directly to the lender’s account.

For payday loans, it is necessary to pay the whole lump sum with an additional fee together. However, in any case, if you can’t pay the loan amounts, you don’t need to be worried. Your loan can be extended for a further period, subjected to the laws of your state.

However, as above, we advise our borrowers to repay debts on time. Otherwise, too many obligations for years may adversely impact your credit score assigned by credit reporting bureaus.

Brokers are Against Hard Credit Check

Your creditworthiness and ability to repay the loan is considered crucial before lending. Many direct lenders are deemed to conduct a hard credit check before lending any loan. However, have they thought of people having bad credit scores? Who will help such people? Maybe us.

Our direct lenders understand all your needs and are against conducting any hard credit inquiry. Instead, they prefer soft credit checks and review your repayment capabilities through other criteria mentioned above in the eligibility section.

Payday Loan Alternatives

Other than instant cash advances, borrowers have many additional options. Some are:

- Installment personal loan which one can pay in series of weekly or monthly payments than lump sum together.

- Being a credit union member, one can borrow short-term loans.

- One can borrow a loan from a bank, but a hard credit inquiry is necessary.

- You can borrow money from friends and relatives.

- One can also borrow money by keeping collateral with the lender. Such loans are:

- Title loans

- Pawnshop loans

FAQs

Conclusion

Whether you are applying for payday loan direct lenders or payday loan brokers, it is solely your choice. Both will help you overcome financial emergencies; however, if you are getting the same privileges of a direct lender loan through brokers, why move here and there. Use payday brokers and connect with hundreds of direct lenders to minimize your chances of rejection.

We tried our best to resolve all your queries regarding brokers and direct lenders; still, you may contact us anytime if you have any other questions. We are 24/7 available for your assistance.